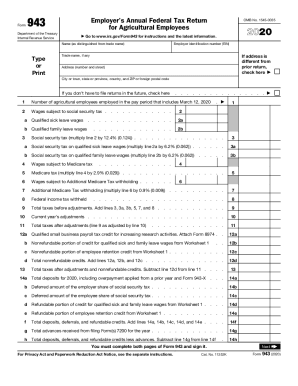

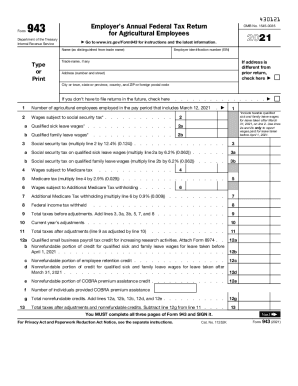

IRS 943-A 2020 free printable template

Get, Create, Make and Sign IRS 943-A

Editing IRS 943-A online

Uncompromising security for your PDF editing and eSignature needs

IRS 943-A Form Versions

How to fill out IRS 943-A

How to fill out IRS 943-A

Who needs IRS 943-A?

Video instructions and help with filling out and completing 943a fillable form

Instructions and Help about IRS 943-A

Mr's president after a long district work period and a national election I'm returning the Senate floor to reassure my weekly waste of the week the presiding officer and my colleagues have watched me come down to the floor 53 times in the hundred and 14th Congress to talk about documented waste fraud and abuse the expenditure of funds that of taxpayer dollars on something that produces no positive effect regardless of which party is controlling any branch of government, and we've had a significant change here in just the last couple of weeks its imperative that our focus remain on governing for the benefit of American people then this includes from my perspective rooting out any kind of waste fraud and abuse found within the federal government taxpayer should demand an effective efficient government that spends money on their money on the behalf of the future of this country and on behalf of their future are our constituents future and when they read about waste fraud and abuse is perfectly natural that they would call on us to address the problem and not spend a dime more than is necessary to run the federal government and pull us out of this ever spiraling deficit spending in deep entrance into debt which may not be able to be repaid and so that's why today I'm taking a look at yet another waste of the week and these called identity theft tax refund fraud which over the past two years has accounted for 23 billion dollars in stolen taxpayer money that's right 23 billion dollars of stolen taxpayer money how does this happen well the theft occurs when criminals gain access to someone else's personal information like their name and their social security number in order to essentially steal the tax refund that might be due owned to them for the tax returns that have been interrupted in sent before the victims tax return goes in often criminals file someone else's tax returns before the victim does and so IRS ends up sending tax refund money to criminals instead of workers that are the money and when such abuse has happened not only is the IRS a note unknowingly paying criminals, but the real tax refunds are denied or seriously delayed to the millions of hardworking Americans who are counting on those refunds so for families that struggle to make ends meet and your tax refunds are often seen as a lifeline but when those families have their tax returns stolen it can take up to a year or more to rectify this mess and sadly many of these criminals prey on senior citizens in low income individuals because they know its more likely that to receive a tax refund and less likely to pursue the lengthy and often complicated process of getting the tax return that's do them some hacking has even been targeted against children under the age of 14 often because parents do not think it's necessary to monitor their children's credit unfortunately this makes children easy targets within the past decade identity theft related tax fraud has just exploded in fact from...

People Also Ask about

What is 943 tax liability?

What kind of payer is 943?

What is the difference between a 941 and a 943?

What is form 943 and when must it be filed?

What is form 943 A?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 943-A from Google Drive?

How can I edit IRS 943-A on a smartphone?

How do I fill out the IRS 943-A form on my smartphone?

What is IRS 943-A?

Who is required to file IRS 943-A?

How to fill out IRS 943-A?

What is the purpose of IRS 943-A?

What information must be reported on IRS 943-A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.