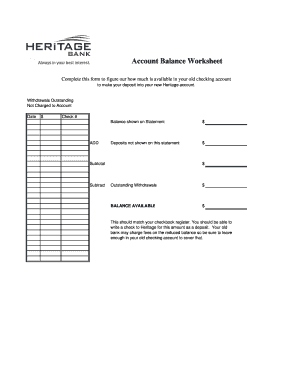

What is Checking Account Balance Worksheet?

The Checking Account Balance Worksheet is a useful tool that helps individuals track and manage their finances. It provides a detailed summary of all the transactions and balances associated with a checking account. This worksheet is designed to make it easier for users to keep track of their income, expenses, and overall account balance.

What are the types of Checking Account Balance Worksheet?

There are several types of Checking Account Balance Worksheets available, catering to different individual preferences and needs. Some common types include:

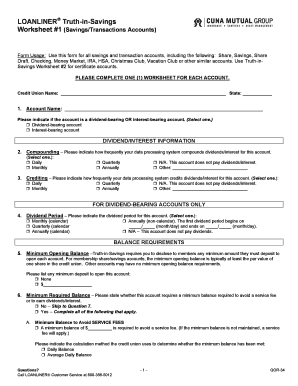

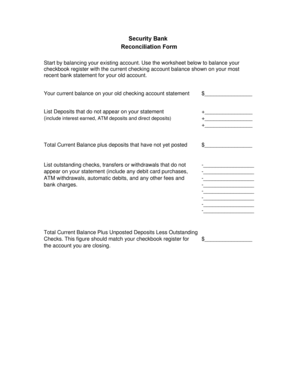

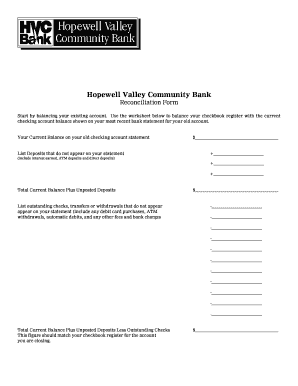

Basic Checking Account Balance Worksheet: This type of worksheet provides a simple and straightforward layout for tracking income, expenses, and balance.

Detailed Checking Account Balance Worksheet: As the name suggests, this worksheet offers a more detailed breakdown of transactions, allowing users to analyze their spending patterns and make informed financial decisions.

Automated Checking Account Balance Worksheet: This type of worksheet is integrated with financial management software and automatically updates transaction information, making it a convenient choice for individuals who prefer automation.

Mobile Checking Account Balance Worksheet: Designed for on-the-go access, this worksheet can be easily accessed and updated using mobile devices, ensuring users always have the latest financial information at their fingertips.

How to complete Checking Account Balance Worksheet

Completing a Checking Account Balance Worksheet is a straightforward process that anyone can follow. Here are the steps to complete the worksheet effectively:

01

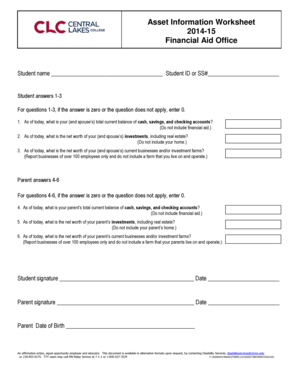

Gather your financial documents, including bank statements, receipts, and any other relevant information.

02

Open the Checking Account Balance Worksheet template. If you're using pdfFiller, you can easily find and customize the template according to your needs.

03

Enter your starting balance in the designated field. This is the amount of money you had in your checking account at the beginning of the specified period.

04

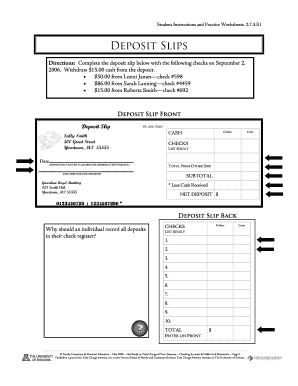

Record all your deposits, including paychecks, refunds, or any other sources of income. Make sure to include the date and amount for each deposit.

05

Track your expenses by recording every transaction, including purchases, bill payments, and withdrawals. Remember to categorize each expense for better analysis.

06

Calculate your ending balance by subtracting the total amount of expenses from the total amount of deposits. This will give you an accurate view of your current account balance.

07

Review the completed worksheet to ensure accuracy and identify any financial trends or areas that require adjustment.

08

Save the completed worksheet and keep it handy for future reference and financial planning.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and professionally.