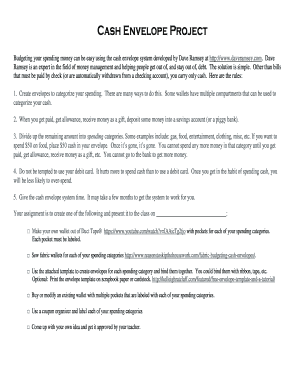

What is dave ramsey budget categories?

Dave Ramsey budget categories are a system that helps individuals and families allocate their income towards different expenses and financial goals. By categorizing expenses, it becomes easier to track spending, prioritize saving, and live within a budget. This method has gained significant popularity due to its simplicity and effectiveness in managing personal finances.

What are the types of dave ramsey budget categories?

There are several commonly used categories in the Dave Ramsey budgeting system. These categories include:

Housing - This category includes expenses related to rent or mortgage payments, property taxes, and homeowner's insurance.

Transportation - It covers costs associated with owning and maintaining a vehicle, such as gas, insurance, repairs, and monthly loan or lease payments.

Food - This category includes groceries, dining out, and any other expenses related to food and beverages.

Utilities - It covers the cost of essential services like electricity, water, internet, and phone bills.

Debt - This category includes payments towards credit cards, student loans, and other outstanding debts.

Savings - It is crucial to allocate a portion of your income towards savings to build an emergency fund, save for retirement, or achieve other financial goals.

Entertainment - This category covers expenses related to leisure activities, such as movies, concerts, vacations, and hobbies.

Healthcare - It includes expenses related to health insurance premiums, medical bills, and prescription medications.

Miscellaneous - This category can be used for any other expenses that do not fit into the other categories, such as gifts, subscriptions, or personal care.

How to complete dave ramsey budget categories

Completing Dave Ramsey budget categories is a straightforward process. Here are the steps you can follow:

01

Start by tracking all your expenses for a given period, such as a month. This can be done using a budgeting app, software, or simply by documenting your expenses manually.

02

Categorize your expenses into the appropriate budget categories mentioned earlier. Be diligent and accurate in assigning each expense to its respective category.

03

Calculate the total amount spent in each category during the tracking period. This will give you an overview of your spending habits and help identify areas where you may need to make adjustments.

04

Compare your expenses with your income and financial goals. Assess whether you are allocating enough funds to savings, paying off debt, and covering essential expenses without overspending.

05

Make necessary adjustments to your budget categories to ensure you are living within your means and aligning your spending with your financial priorities.

06

Continuously monitor your expenses and track your progress. Regularly reviewing and adjusting your budget categories will help you stay on track and make informed financial decisions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.