Multiple Credit Card Payoff Calculator

What is multiple credit card payoff calculator?

A multiple credit card payoff calculator is a financial tool that helps individuals determine the most efficient and cost-effective way to pay off their credit card debts. It takes into account the balance, interest rates, and minimum payment amounts of multiple credit cards and provides a plan to pay them off faster and save money on interest.

What are the types of multiple credit card payoff calculator?

There are several types of multiple credit card payoff calculators available:

Snowball Method Calculator: This type of calculator focuses on paying off the smallest balance credit card first, while making minimum payments on other cards. As each card is paid off, the extra payment is applied to the next smallest balance, creating a snowball effect.

Avalanche Method Calculator: The avalanche method calculator prioritizes paying off the credit card with the highest interest rate first. It helps to save more on interest over time.

Consolidation Loan Calculator: This calculator helps determine whether consolidating credit card debts with a personal loan is a viable option. It considers the loan interest rate, term, and monthly payment to provide insights on potential savings.

Customizable Payment Calculator: This type of calculator allows users to input their desired payment amount and see how it affects their credit card payoff timeline and savings.

Debt Management Plan Calculator: A debt management plan calculator helps individuals create a comprehensive plan to pay off all their debts, including credit cards. It considers their monthly income, expenses, and debt details to provide a tailored strategy.

How to complete multiple credit card payoff calculator?

Completing a multiple credit card payoff calculator is easy and straightforward. Here are the steps:

01

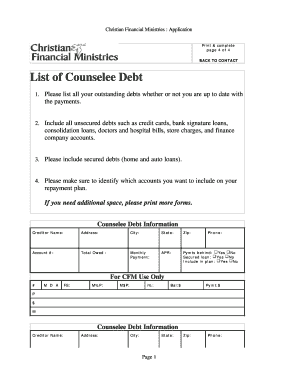

Gather necessary information: Collect all the credit card statements and note down the outstanding balance, interest rates, and minimum payment amounts.

02

Choose a calculator: Select the type of multiple credit card payoff calculator that aligns with your debt repayment goals. Remember, different calculators have different methodologies.

03

Input the details: Enter the relevant information into the calculator, including credit card balances, interest rates, minimum payments, and any extra payment you can afford to make each month.

04

Analyze the results: Once you input all the data, the calculator will generate a detailed plan showing how to distribute your payments among the credit cards to pay them off efficiently. It will also provide estimates on the time required to become debt-free and the potential interest savings.

05

Follow the plan: Stick to the generated plan and make the suggested payments each month. Adjust your budget as needed to meet the payment goals.

06

Monitor progress: Regularly track your progress using the calculator to stay motivated and celebrate milestones.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you calculate when a loan will be paid off in Excel?

=PMT( Rate, Nper, Pv, Fv, Type) Nper: Total no. of periods - Pv: Initial Value of the loan (has to be negative for PMT formula). Fv (optional): Fv stands for future value. If after paying off the last loan payment, you want to have any balance left it is the future value.

How do you use the PMT function in Excel?

Excel PMT Function Summary. Get the periodic payment for a loan. loan payment as a number. =PMT (rate, nper, pv, [fv], [type]) rate - The interest rate for the loan. The PMT function can be used to figure out the future payments for a loan, assuming constant payments and a constant interest rate.

How do I know which debt to pay off first?

Debt by Interest Rate With this strategy, you'll pay off the loan with the highest interest first while continuing to make minimum payments on your other debt. Once your highest-interest debt is paid in full, put the extra money you used for the paid-off debt toward the card with the second-highest interest rate.

How do I calculate debt payoff in Excel?

P = Ai / (1 – (1 + i)-N) where: P = regular periodic payment. A = amount borrowed. i = periodic interest rate. N = total number of repayment periods.

Is it better to pay off big or small credit cards first?

Consider Paying Credit Cards With the Highest Interest First You'll typically save the most money if you get rid of high interest debt as quickly as possible. The longer interest accrues on a balance, the more you'll pay.

How do I make a debt payoff in Excel?

Step 1: Look up your individual debts and interest rates Step 2: Input your debt information into your debt snowball spreadsheet. Step 3: Add Dates in Column A of Your Debt Payoff Spreadsheet. Step 4: Calculate how much you actually pay off with each payment. Step 5: Calculate the Debt Snowball Spreadsheet in Action.

Related templates