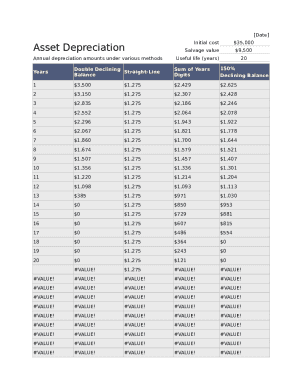

What is Asset Depreciation Schedule Calculator?

An Asset Depreciation Schedule Calculator is a tool used by businesses to calculate the decrease in value of their assets over time. This calculation is essential for determining the financial health of a company and for tax purposes.

What are the types of Asset Depreciation Schedule Calculator?

There are several types of Asset Depreciation Schedule Calculators, including: Straight-line method, Double-declining balance method, Units of production method, Sum-of-the-years-digits method.

How to complete Asset Depreciation Schedule Calculator

To complete an Asset Depreciation Schedule Calculator, follow these steps: 1. Gather all necessary information about the asset. 2. Choose the appropriate depreciation method. 3. Input the asset's original cost and useful life. 4. Calculate the depreciation expense each period. 5. Update the schedule regularly to reflect changes in the asset's value.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.