Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form refers to the structure, shape, or arrangement of an object. In the context of design and art, it can be described as the visual or physical appearance of an artwork or object. It often refers to the overall shape or configuration, as well as the arrangement and organization of its various elements. In literature, form can refer to the structure or style of a written work, such as a poem, play, or novel.

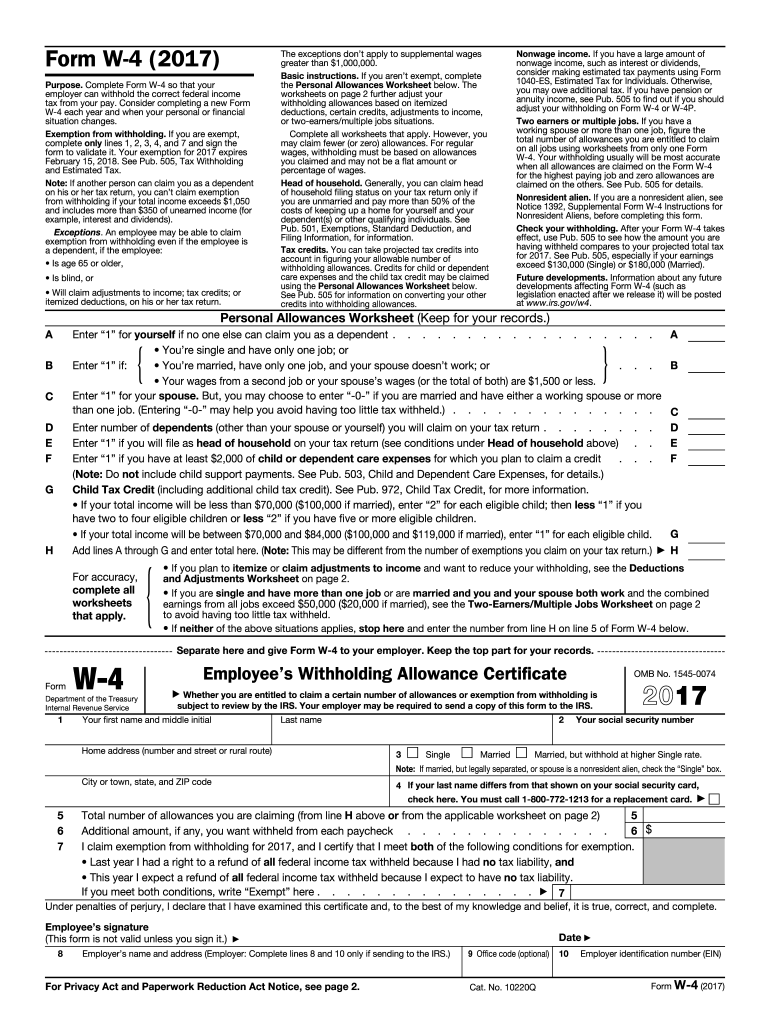

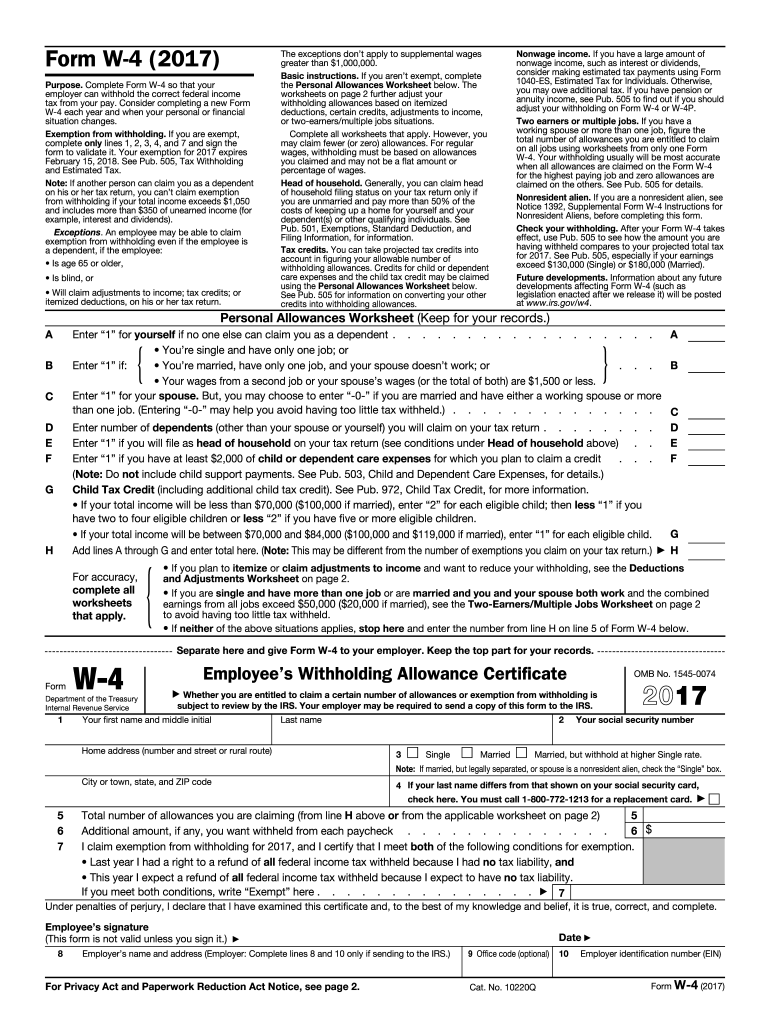

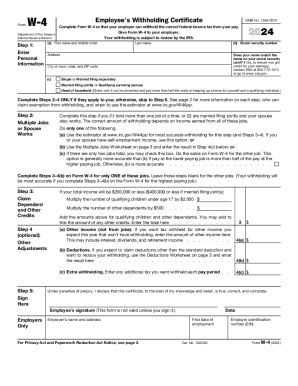

Who is required to file form?

It is difficult to answer this question without more context. It depends on which form you are referring to. Generally, individuals and businesses may be required to file various forms for tax purposes, reporting certain financial transactions, applying for government benefits, or fulfilling other legal obligations. The specific requirements vary depending on jurisdiction and the type of form being referred to.

When filling out a form, follow these steps:

1. Read the instructions: Begin by carefully reading the instructions on the form to understand what information is required and how it should be provided.

2. Obtain necessary information: Gather all the necessary information you will need to complete the form. This may include personal details, contact information, identification numbers, dates, and any other relevant information required.

3. Use black or blue ink: Generally, forms should be filled out using black or blue ink to ensure clarity and legibility. Some forms may also allow for online or digital completion.

4. Start with personal details: Begin by providing your personal information such as your full name, address, date of birth, and phone number. The order and type of personal information may vary depending on the form's purpose.

5. Provide identification details: If the form requires any identification numbers (such as a social security number or driver's license number), include them accurately.

6. Follow formatting instructions: Pay attention to the form's formatting guidelines. For example, some forms may require the date to be entered in a specific format (e.g., MM/DD/YYYY).

7. Provide required information: Fill in the necessary information based on the form's requirements. This could include answering questions, selecting options, or providing specific details.

8. Double-check for accuracy: Before submitting the form, thoroughly review it for any errors or omissions. Ensure that all entered information is accurate and complete.

9. Sign and date the form: If there is a dedicated space for a signature, sign your name exactly as indicated. Additionally, date the form with the current date.

10. Submit the form: Depending on the instructions provided, submit the form by mail, in person, or electronically through email, online submission, or a specific platform.

Remember to keep a copy of the filled-out form for your records before submitting it.

What is the purpose of form?

The purpose of a form is to collect information from users or individuals in a structured manner. Forms are commonly used in various industries and contexts, such as online registration, surveys, application forms, feedback forms, order forms, and many more. They allow organizations or individuals to gather specific data, preferences, opinions, or feedback from users, which can be used for different purposes including analysis, decision-making, communication, record-keeping, or providing services. Forms provide a standardized format for gathering information, ensuring consistency and efficiency in data collection.

What is the penalty for the late filing of form?

The penalty for late filing of a form can vary depending on the specific form and the jurisdiction (such as country or state) in which it is required. In general, late filing penalties may include:

1. Late filing fees: Many forms require a fee for filing, and if the form is filed after the due date, an additional late filing fee may be imposed.

2. Interest charges: Some forms, especially those related to taxes or financial transactions, may accrue interest on any amounts owed if they are filed late.

3. Reduced deductions or benefits: Certain forms, such as tax returns, may impose penalties in the form of reduced deductions or benefits if they are filed late.

4. Legal consequences: In some cases, late filing of certain forms may have legal consequences, such as legal action, fines, or loss of certain rights or privileges.

It is important to consult the specific guidelines and regulations for each form to understand the potential penalties for late filing.

How can I manage my form 2017 - irs directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 2017 - irs and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for signing my form 2017 - irs in Gmail?

Create your eSignature using pdfFiller and then eSign your form 2017 - irs immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out form 2017 - irs on an Android device?

Complete your form 2017 - irs and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.