Canada Customs Invoice Excel

What is canada customs invoice excel?

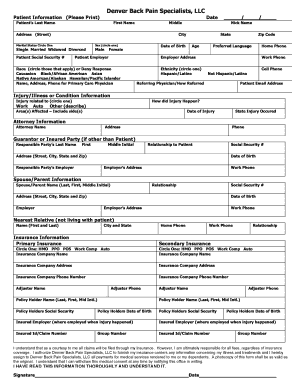

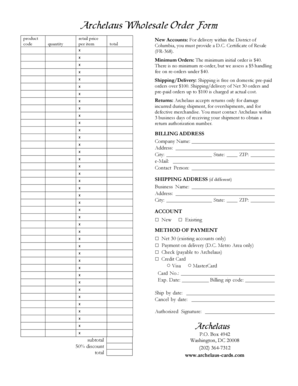

A Canada Customs Invoice (CCI) in excel format is a document required by the Canada Border Services Agency (CBSA) for all goods imported into Canada. It is used to declare the value and description of the imported goods, as well as other relevant information such as the country of origin and the exporter's details.

What are the types of canada customs invoice excel?

There are two main types of Canada Customs Invoice (CCI) templates in excel format:

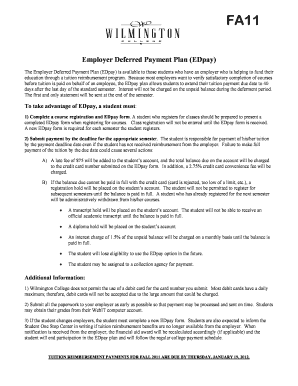

Standard CCI: This template is used for regular commercial shipments and includes fields for all necessary information needed for customs clearance.

Simplified CCI: This template is used for low-value shipments or shipments that qualify for simplified customs procedures. It requires less information compared to the standard CCI.

How to complete canada customs invoice excel

To complete a Canada Customs Invoice (CCI) in excel format, follow these steps:

01

Open the Canada Customs Invoice excel template.

02

Fill in the exporter's details, including name, address, and contact information.

03

Provide the buyer's details, including name, address, and contact information.

04

Enter the country of origin for the imported goods.

05

Describe the goods being imported, including the quantity, unit price, and total value.

06

Include any additional charges or discounts if applicable.

07

Calculate the total value of the goods and any additional charges.

08

Sign and date the completed CCI.

09

Save the completed CCI in excel format for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write an invoice for customs?

A customs invoice should include all the information necessary for the shipment to clear customs, including: The type of imported goods. Shipping weight. The value of goods. Import duty and taxes.

How do I complete a customs invoice Canada?

CI1 – Canada Customs Invoice Vendor (name and address) Date of direct shipment to Canada (yyyy/mm/dd) Other references (include purchaser's order No.) Consignee (name and address) Purchaser's name and address (if other than consignee) Country of transhipment.

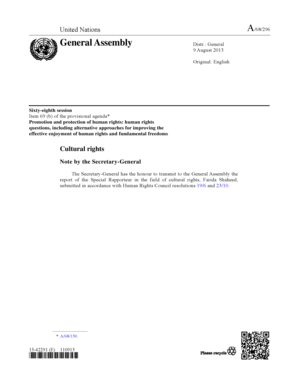

What is the purpose of Canadian customs invoice?

The importer uses the CCI to pay the seller for the goods. The exporter uses the CCI to collect payment from the buyer.

What is required on a customs invoice?

The customs invoice must have the purchase price or value of all goods in the currency of the sale. The invoice must include and itemize additional charges such as insurance, freight, packing costs and commissions as well as any discounts from rebates, drawbacks and production assists.

Do I need a Canada customs invoice?

Canada Customs Invoices or commercial invoices containing all the CCI data, are required when: the value of the goods is CA $1,600 or more. the value of Canadian goods being returned has been increased by CA $1,600 or more. the goods are not unconditionally duty-free regardless of end-use or value.

What is the difference between a commercial invoice and a Canada customs invoice?

According to the Canada Border Services Agency, the Canada Customs Invoice (CCI) is a special invoice that incorporates more data elements than a standard commercial invoice.

Related templates