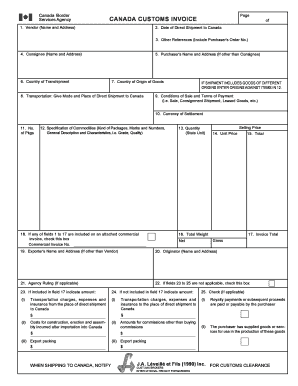

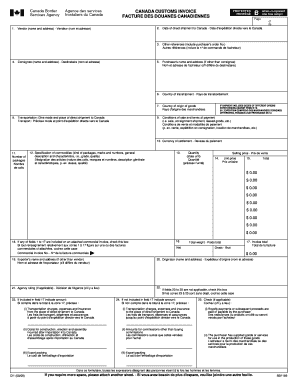

What is canada customs invoice requirements?

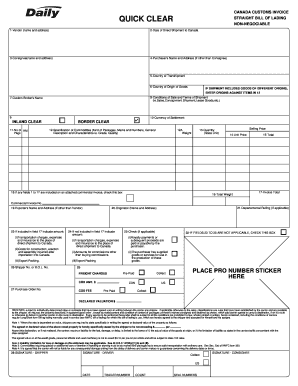

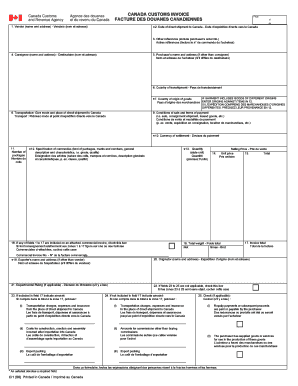

Canada Customs Invoice (CCI) requirements refer to the specific information and documentation that must be provided when importing goods into Canada. The CCI serves as a declaration of the value, quantity, and nature of the imported goods, as well as other relevant details such as the country of origin. It is a crucial document required by the Canada Border Services Agency (CBSA) to assess and verify the importation of goods.

What are the types of canada customs invoice requirements?

There are several types of requirements that must be met when completing a Canada Customs Invoice:

Correct and complete information: Accuracy and completeness of the information provided in the CCI is of utmost importance.

Itemized description: A detailed description of the imported goods, including their value, quantity, and country of origin, should be included.

Harmonized System (HS) code: Each item on the CCI must be assigned the appropriate HS code, which is an internationally standardized system for classifying traded products.

Packing list: A packing list detailing the packaging of the goods, such as the number and type of containers, should be attached.

Declaration of origin: A declaration of origin, stating the country from which the goods originate, must be included on the CCI.

Importer information: The CCI should contain the contact and identification details of the importer, such as their name, address, and business number.

Exporter information: Similarly, the exporter's information, including their name and address, should be provided on the CCI.

Currency and payment terms: The currency in which the transaction is conducted, as well as the agreed-upon payment terms, need to be specified.

Signatures and dates: The CCI should be signed and dated by both the exporter and the importer.

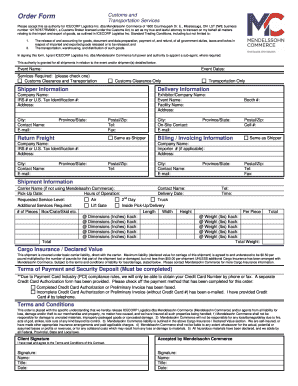

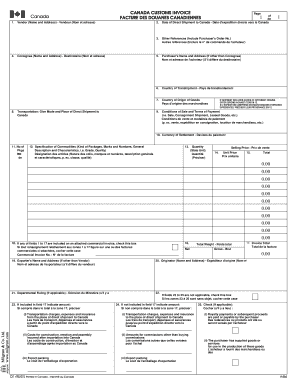

How to complete canada customs invoice requirements

To complete the Canada Customs Invoice requirements, follow these steps:

01

Gather all the necessary information and documents regarding the imported goods.

02

Ensure the accuracy and completeness of the information to be provided.

03

Assign the appropriate HS codes to each item on the invoice.

04

Prepare a packing list that describes the packaging of the goods in detail.

05

Include a declaration of origin, stating the country from which the goods originate.

06

Provide the importer's and exporter's information, including their contact details.

07

Specify the currency in which the transaction is conducted and the agreed-upon payment terms.

08

Sign and date the Canada Customs Invoice.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.