Income Tax Calculator

What is Income Tax Calculator?

An income tax calculator is a tool that helps individuals estimate the amount of tax they need to pay based on their income. It takes into account various factors such as income sources, deductions, and exemptions to provide an accurate estimate. Using an income tax calculator can help individuals plan their finances better and ensure they are prepared for their tax obligations.

What are the types of Income Tax Calculator?

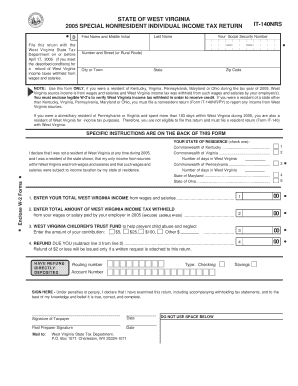

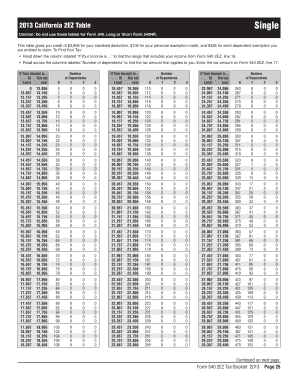

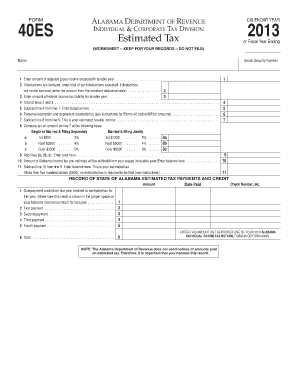

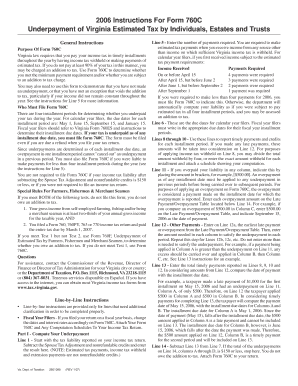

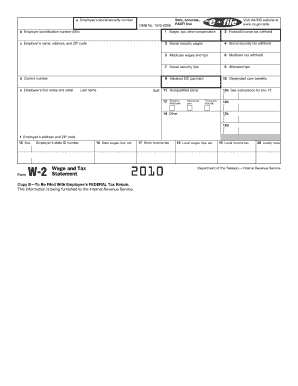

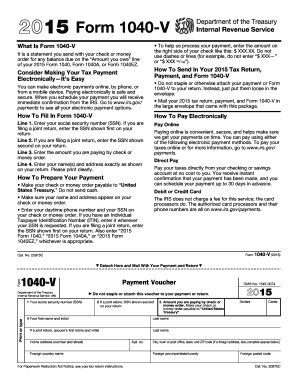

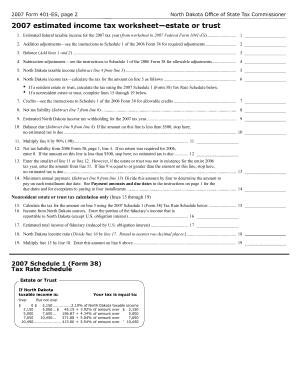

There are different types of income tax calculators available that cater to specific needs and locations. Some common types include: 1. Federal income tax calculator: Calculates tax obligations for individuals paying taxes to the federal government. 2. State income tax calculator: Calculates tax obligations for individuals paying taxes to a specific state. 3. Self-employment tax calculator: Specifically designed for self-employed individuals to calculate their tax liabilities which include both income and self-employment taxes. 4. International income tax calculator: Used by individuals who have income in multiple countries and need to determine their tax liabilities in each jurisdiction.

How to complete Income Tax Calculator

Completing an income tax calculator is a relatively simple process. Here are the steps you can follow: 1. Gather all necessary information: Collect all relevant financial documents such as income statements, deductions, and exemptions. 2. Enter your income details: Input your income from various sources such as salary, investments, and rental income. 3. Provide deductions and exemptions: Include any eligible deductions and exemptions that can reduce your taxable income. 4. Review and verify: Double-check all the entered information for accuracy. 5. Generate the tax estimate: After entering all the required details, the income tax calculator will provide an estimated tax liability. 6. Plan accordingly: Once you have the estimated tax amount, you can plan ahead and make necessary adjustments to meet your tax obligations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.