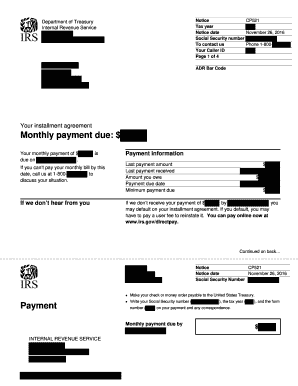

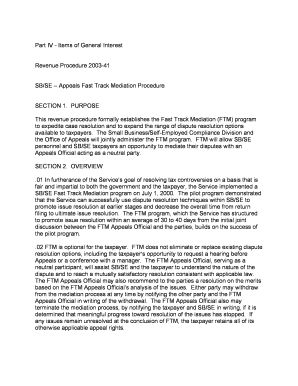

Irs Payment Agreement

What is irs payment agreement?

An IRS payment agreement, also known as an installment agreement, is a formal arrangement between a taxpayer and the Internal Revenue Service (IRS) to pay back their tax debt in smaller, more manageable monthly installments. This agreement allows individuals and businesses to fulfill their tax obligations without facing severe financial hardship or penalties.

What are the types of irs payment agreement?

There are several types of IRS payment agreements available, depending on the taxpayer's financial situation:

Guaranteed Installment Agreement: This agreement is available for individual taxpayers who owe $10,000 or less in tax debt and can pay it off within three years.

Streamlined Installment Agreement: Designed for taxpayers who owe between $10,000 and $50,000, this agreement allows them to pay off their debt within six years.

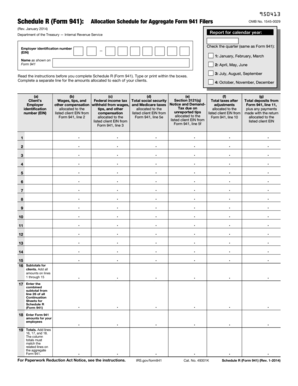

In-Business Trust Fund Express Installment Agreement: This agreement is specifically for businesses that owe payroll taxes.

Partial Payment Installment Agreement: Available to taxpayers who cannot afford to pay off their full tax debt, this agreement allows them to make reduced monthly payments based on their financial capability.

Non-Streamlined Installment Agreement: This agreement is for taxpayers who owe more than $50,000 or need more than six years to pay off their tax debt.

Offer in Compromise: Although not technically an installment agreement, an Offer in Compromise allows taxpayers to settle their tax debt for less than the full amount owed if they can prove that paying the full amount would cause financial hardship.

How to complete irs payment agreement

Completing an IRS payment agreement involves the following steps:

01

Determine your eligibility: Understand which type of IRS payment agreement suits your financial situation best.

02

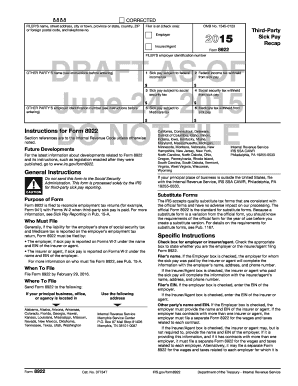

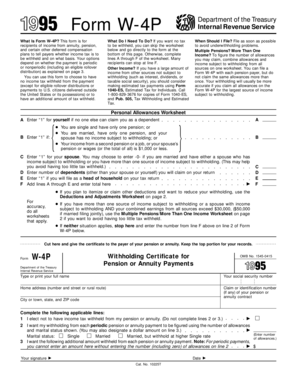

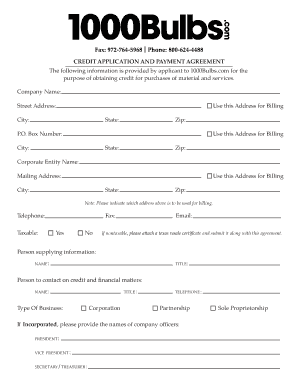

Gather necessary documentation: Collect all relevant financial information, including tax returns, income statements, and bank statements.

03

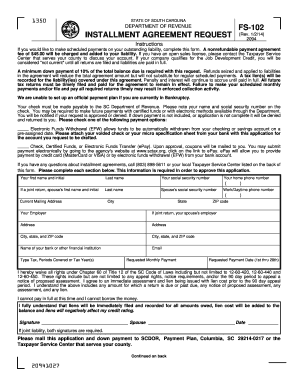

Submit Form Fill out and submit IRS Form 9465, Installment Agreement Request, along with any required supporting documents.

04

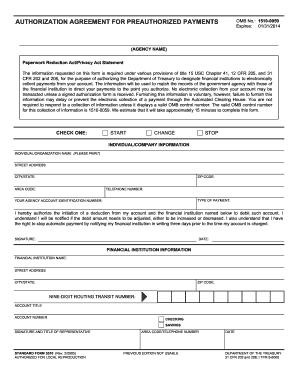

Consider automatic payments: Set up automatic payments through the IRS Direct Pay system or the Electronic Federal Tax Payment System (EFTPS) for convenience and to ensure timely payments.

05

Review and sign the agreement: Carefully review the terms and conditions of the agreement, including the payment schedule, interest rates, and penalties. Sign the agreement and submit it to the IRS.

06

Make regular payments: Once the agreement is approved, make regular monthly payments according to the agreed-upon terms.

07

Monitor your account: Keep track of your payments and maintain communication with the IRS to avoid any issues or misunderstandings.

08

Seek professional help if needed: If you find the process overwhelming or need assistance, consider consulting a tax professional or reaching out to a taxpayer advocate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out irs payment agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What form is needed for IRS payment plan?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

How long can you be on a payment plan with the IRS?

Short-term payment plan – The payment period is 120 days or less and the total amount owed is less than $100,000 in combined tax, penalties and interest.

Can I make a payment agreement with the IRS?

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee.

How do I get an IRS payment agreement?

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool using the Apply/Revise button below.

Can I pay IRS installment agreement online?

For individuals and businesses: Apply online for a payment plan (including installment agreement) to pay off your balance over time. Fees apply.

What documents do I need to make a payment plan with the IRS?

If you are filing a Form 1040 for the current tax year and cannot pay the balance in full: You may request a payment plan (including an installment agreement) using the OPA application. Alternatively, you may submit a Form 9465 with your return.

Related templates