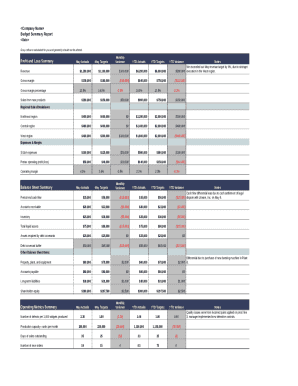

What is Budget Summary Template?

A Budget Summary Template is a useful tool that helps individuals or businesses track their expenses and income in an organized manner. It provides a clear overview of financial data and can be used to make informed decisions about budgeting and planning for the future.

What are the types of Budget Summary Template?

There are several types of Budget Summary Templates available, including: Basic Budget Summary Template, Monthly Budget Summary Template, Yearly Budget Summary Template, Project Budget Summary Template, and Business Budget Summary Template.

How to complete Budget Summary Template

Completing a Budget Summary Template is simple and easy with the right tools. Follow these steps to create an accurate budget summary: 1. Gather all relevant financial data, including income and expenses. 2. Input the data into the appropriate sections of the template. 3. Review the summary to ensure accuracy and make any necessary adjustments. 4. Use the information to make financial decisions and plan for the future.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.