What is Checklist For Tax Deductions?

A Checklist for Tax Deductions is a list of items or expenses that you can deduct from your taxable income to reduce the amount of tax you owe. It helps you keep track of eligible deductions and ensure you are not missing out on any tax-saving opportunities.

What are the types of Checklist For Tax Deductions?

There are various types of deductions that can be included in a Checklist for Tax Deductions. Some common types include:

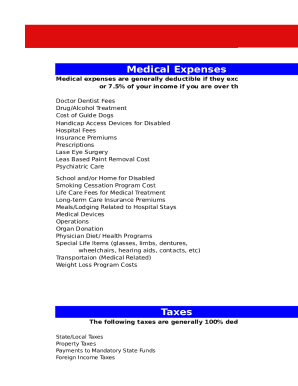

Personal expenses such as mortgage interest, medical expenses, and charitable contributions

Business expenses like office supplies, travel costs, and vehicle expenses

Education expenses including tuition fees and student loan interest

How to complete Checklist For Tax Deductions

Completing a Checklist for Tax Deductions is essential for maximizing your tax savings. Here are some steps to help you complete your checklist:

01

Gather all relevant receipts and documents related to your expenses

02

Organize the items into categories such as personal, business, and education expenses

03

Review each expense to ensure it meets the criteria for tax deductions

04

Input the total amount for each category in your checklist

05

Double-check your checklist for accuracy and completeness before submitting it with your tax return

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Checklist For Tax Deductions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the top 10 tax deductions?

Here's a list of 20 popular ones and links to our other content that will help you learn more. Child tax credit. Child and dependent care credit. American opportunity tax credit. Lifetime learning credit. Student loan interest deduction. Adoption credit. Earned income tax credit. Charitable donations deduction.

What are the top 10 deductions?

Here's a list of 20 popular ones and links to our other content that will help you learn more. IRA contributions deduction. 401(k) contributions deduction. Saver's credit. Health savings account contributions deduction. Self-employment expenses deduction. Home office deduction. Educator expenses deduction. Solar tax credit.

Do I need receipts for tax write offs?

The Internal Revenue Service allows you to deduct expenses that are ordinary and necessary for the operation of your business. However, if you are audited, you need to show receipts for these deductions. So, you should keep receipts for everything you plan to write off when you file taxes for your business.

What information do you need for tax deductions?

If you're self-employed, many business expenses are also tax deductible. To document both personal and business expenses, make sure you have all your receipts, invoices, medical bills, and mileage logs. It's also a good idea to have a copy of your latest tax return on hand.

Can you write off gas on taxes?

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted."

Who benefits most from tax deductions?

Lower Income Households Receive More Benefits as a Share of Total Income. Overall, higher-income households enjoy greater benefits, in dollar terms, from the major income and payroll tax expenditures.