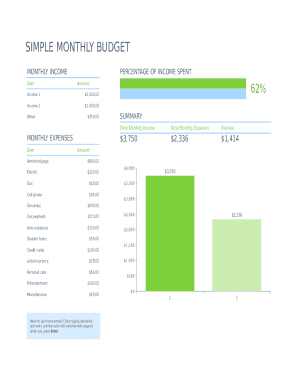

What is Simple Monthly Budget Template?

A Simple Monthly Budget Template is a tool used to track expenses and income on a monthly basis. It helps users organize their finances, set financial goals, and stay on top of their budget.

What are the types of Simple Monthly Budget Template?

There are various types of Simple Monthly Budget Templates available, including:

Basic monthly budget template

Family budget template

Personal finance budget template

Business budget template

Savings budget template

How to complete Simple Monthly Budget Template

Completing a Simple Monthly Budget Template is easy with these steps:

01

Gather all your financial information, including income sources and expenses.

02

Fill in the template with your financial data.

03

Review the completed budget to ensure accuracy and adjust as needed.

04

Use the budget to track your spending and make informed financial decisions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple Monthly Budget Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I budget money for free for beginners?

Best free budgeting tools Best free spreadsheet for anyone: Google Sheets. Best overall free smartphone app: Mint. Best free smartphone app for beginners: Goodbudget. Best free smartphone app for investors: Personal Capital. Best free desktop software for small business owners: GnuCash.

How should a beginner budget?

Follow the steps below as you set up your own, personalized budget: Make a list of your values. Write down what matters to you and then put your values in order. Set your goals. Determine your income. Determine your expenses. Create your budget. Pay yourself first! Be careful with credit cards. Check back periodically.

How do I create a free budget spreadsheet?

The Easy (and Free) Way to Make a Budget Spreadsheet Step 1: Pick Your Program. First, select an application that can create and edit spreadsheet files. Step 2: Select a Template. Step 3: Enter Your Own Numbers. Step 4: Check Your Results. Step 5: Keep Going or Move Up to a Specialized App.

What's the 50 30 20 budget rule?

One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

How to make a simple monthly budget?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How do you create a monthly budget for a beginner?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.