What is Detailed Personal Budget Workbook?

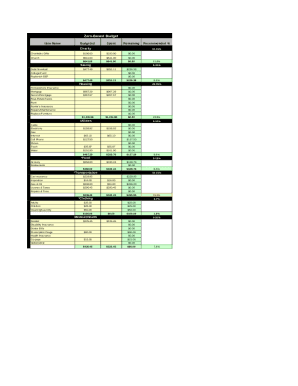

A Detailed Personal Budget Workbook is a comprehensive tool designed to help individuals track and manage their finances more effectively. It allows users to organize their income, expenses, savings, and financial goals in one place, providing a clear overview of their financial situation.

What are the types of Detailed Personal Budget Workbook?

There are several types of Detailed Personal Budget Workbooks available, including:

Traditional paper-based workbook

Digital spreadsheet workbook

Online budgeting tool

How to complete Detailed Personal Budget Workbook

Completing a Detailed Personal Budget Workbook is a simple process that can greatly benefit your financial management. Here are the steps to follow:

01

Gather all your financial information, including income sources, expenses, debts, and savings goals

02

Enter your financial data into the appropriate sections of the workbook

03

Regularly update your budget workbook to track your progress and make adjustments as needed

Using a Detailed Personal Budget Workbook can help you gain better control over your finances and achieve your financial goals. With tools like pdfFiller, creating and managing your budget workbook online has never been easier.

Video Tutorial How to Fill Out Detailed Personal Budget Workbook

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

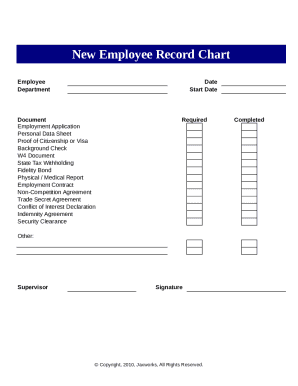

What should be included in a detailed budget?

Common expenses to include in your budget include: Housing. Whether you own your own home or pay rent, the cost of housing is likely your biggest monthly expense. Utilities. Vehicles and transportation costs. Gas. Groceries, toiletries and other essential items. Internet, cable and streaming services. Cellphone. Debt payments.

What are the four components to a personal budget?

Everyone has four basic components in their financial structure: assets, debts, income, and expenses. Measuring and comparing these can help you determine the state of your finances and your current net worth.

Does Excel have a personal budget template?

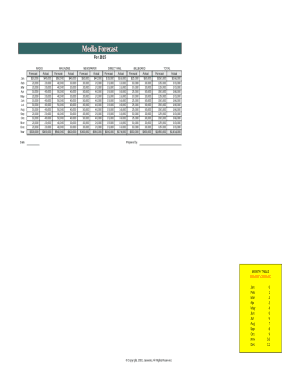

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

What is the 70 20 10 rule money?

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What are the 7 steps in creating a budget?

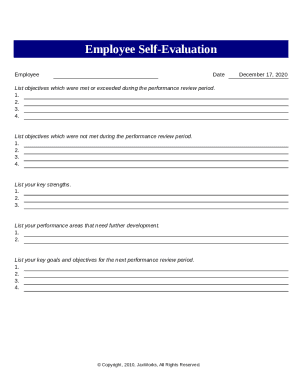

Follow these seven steps to start a personal budget that can help you reach your financial goals: Calculate your income. Make lists of your expenses. Set realistic goals. Choose a budgeting strategy. Adjust your habits. Automate your savings and bills. Track your progress.

How do you create a detailed personal budget?

Five simple steps to create and use a budget Step 1: Estimate your monthly income. Step 2: Identify and estimate your monthly expenses. Step 3: Compare your total estimated income and expenses, and consider your priorities and goals. Step 4: Track your spending, and at the end of month, see if you spent what you planned.

Related templates