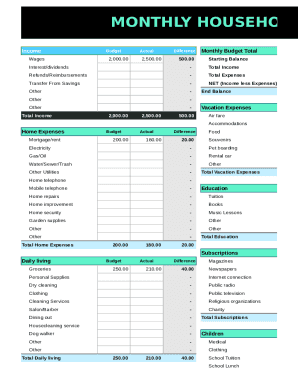

Monthly Household Budget Sheet

What is Monthly Household Budget Sheet?

A Monthly Household Budget Sheet is a tool used to track and manage your household expenses and income for a specific month. It helps you understand where your money is going and allows you to set financial goals for better financial management.

What are the types of Monthly Household Budget Sheet?

There are different types of Monthly Household Budget Sheets based on complexity and purpose, including basic budget sheets, detailed budget sheets, zero-based budget sheets, and customizable budget sheets.

How to complete Monthly Household Budget Sheet

Completing a Monthly Household Budget Sheet is easy and essential for effective financial planning. Start by gathering all your financial information, including monthly income, fixed expenses, variable expenses, and savings goals. Then, follow these simple steps:

By using tools like pdfFiller, you can easily create and edit your Monthly Household Budget Sheet online. pdfFiller offers unlimited fillable templates and powerful editing tools to streamline your document management process.