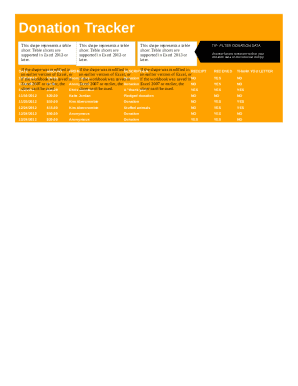

What is Donation Tracker?

A Donation Tracker is a tool used to keep track of charitable donations, whether it's money, goods, or services. It helps individuals and organizations stay organized and maintain accurate records of their contributions.

What are the types of Donation Tracker?

There are various types of Donation Trackers available to suit different needs and preferences. Some popular ones include:

Spreadsheet-based trackers

Online donation management platforms

Mobile apps

How to complete Donation Tracker

Completing a Donation Tracker is essential to ensure your records are up-to-date and accurate. Here are some steps to help you complete your Donation Tracker effectively:

01

Gather all your donation receipts and documentation

02

Enter donation details such as date, amount, and recipient into the tracker

03

Regularly update the tracker with new donations to maintain accurate records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation Tracker

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I know if my donation goes to charity?

Always check with the IRS website at https://.irs.gov/Charities-&-Non-Profits/Exempt-Organizations-Select-Check.

Does its deductible still exist?

Your account allows you to access your information year-round to add or edit your deductions. We heard you and we listened! ItsDeductible service will continue — 2023 donation tracking is now available. More information here.

How do I invoice a charity donation?

What to include on your invoice for a charitable donation. The donor's name. The name of the nonprofit or charity (plus the gift officer's name and title, if applicable) The date that the donation was made. The donation amount. A signature from the nonprofit or charity that verifies the invoice.

How do you keep track of donations?

A bank record, like a canceled check or a bank or credit card statement. A receipt, letter or other written communication from the qualified charity.

How do I keep track of charitable donations?

You'll need a record that includes the name of the charity and the date and amount of the contribution. One of the following, showing the date and amount of your contribution, can substantiate charitable contributions: A bank record, like a canceled check or a bank or credit card statement.

How do I track charitable donations in mint?

To see a list of your total charitable donations, for example, go to the Trends section and view by Spending Over Time. In the text box, start typing Charity (or whatever category you're searching) and select it from the dropdown list that appears.