What is Family Expenses Sheet?

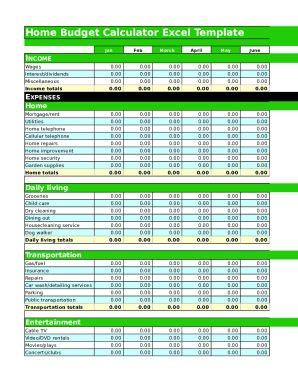

A Family Expenses Sheet is a tool used to track and monitor all the expenses incurred by a family. It helps in organizing and managing finances effectively.

What are the types of Family Expenses Sheet?

There are two main types of Family Expenses Sheets: 1. Manual Family Expenses Sheet - where expenses are recorded manually on a paper or spreadsheet. 2. Digital Family Expenses Sheet - where expenses are recorded using online tools or apps for easier tracking and analysis.

Manual Family Expenses Sheet

Digital Family Expenses Sheet

How to complete Family Expenses Sheet

Completing a Family Expenses Sheet is simple and can be done in a few easy steps:

01

Gather all receipts and bills for expenses incurred by the family.

02

List down each expense item along with the amount paid.

03

Categorize expenses into different categories like groceries, utilities, entertainment, etc.

04

Total up all expenses to get a clear picture of the family's spending.

05

Make any necessary adjustments to budget or spending habits based on the analysis.

06

Regularly update the Family Expenses Sheet to stay on top of finances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Family Expenses Sheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 50 20 30 budget rule?

By Melissa Green | Citizens Bank Staff One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

What is the 50-30-20 rule in business?

The 50/30/20 rule is a budgeting method that dictates that you should break your money down into three different categories: 50% for necessities, 30% for discretionary spending, and 20% for savings. This can be a helpful guideline for online businesses that are trying to manage their finances better.

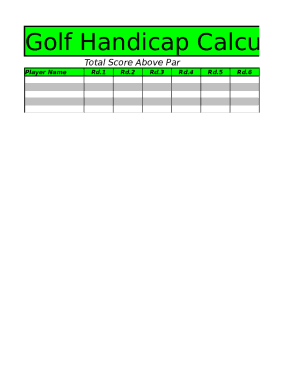

How do I create a family income expense sheet in Excel?

0:34 10:28 Creating a Family Budget with Excel - YouTube YouTube Start of suggested clip End of suggested clip So here i am in microsoft excel. And i will just go here to the upper. Left click on file. AndMoreSo here i am in microsoft excel. And i will just go here to the upper. Left click on file. And select new and this brings up the screen where i can start a new blank workbook.

What is the 75 15 10 rule?

for anybody with any amount of money. so for every dollar you make, you can spend 75 cents. then 15 cents is the minimum that you can invest, and 10 cents is the minimum that you save.

How do you distribute your money when using the 50-20-30 rule?

By Melissa Green | Citizens Bank Staff One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

What is a sample of a 50-30-20 budget?

Monthly budget example 50% of $2,400 is $1,200. 30% is $720. 20% is $480. If 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your “wants” money, or even your savings, if necessary.