What is Family Budget Workshop?

A Family Budget Workshop is a hands-on session where individuals or families come together to learn how to manage their finances effectively. During the workshop, participants will learn how to create a budget, track their expenses, and set financial goals.

What are the types of Family Budget Workshop?

Family Budget Workshops can come in different formats to cater to the specific needs of participants. Some common types of workshops include:

In-person workshops conducted by financial experts

Online workshops with interactive tools and resources

Workshops tailored for specific groups like college students or retirees

How to complete Family Budget Workshop

To successfully complete a Family Budget Workshop, follow these steps:

01

Attend the workshop sessions and actively participate in discussions and activities

02

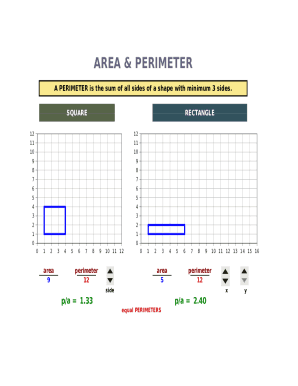

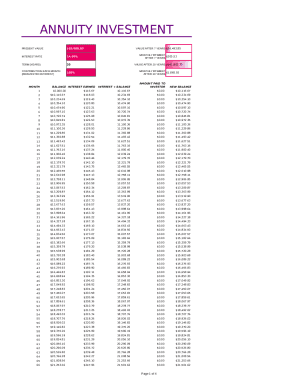

Use the tools and resources provided to create your budget and track your expenses

03

Set realistic financial goals and create an action plan to achieve them

Remember, tools like pdfFiller can empower you to create, edit, and share your budget documents online securely. With unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor for all your document needs.

Video Tutorial How to Fill Out Family Budget Workshop

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What's the 50 30 20 budget rule?

One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

Does 50 30 20 include 401k?

Important reminder: The 50/30/20 budget rule only considers your take-home pay for the month, so anything automatically deducted from your paycheck — like your work health insurance premium or 401k retirement contribution — doesn't count in the equation.

What is the 50 40 10 budgeting rule and how is it broken down?

that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 40% on wants, and 10% on savings or paying off debt.

How do you organize a family budget?

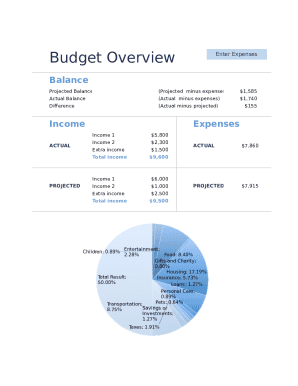

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What is a budgeting workshop?

Budget workshops can offer the general public, as well as organized stakeholders, an opportunity to question, comment on, and shape budget goals and development. Workshops may involve gatherings of various sizes and will often make use of a facilitator.

What are the 9 components of a family budget?

The Essential Budget Categories Housing (25-35 percent) Transportation (10-15 percent) Food (10-15 percent) Utilities (5-10 percent) Insurance (10-25 percent) Medical & Healthcare (5-10 percent) Saving, Investing, & Debt Payments (10-20 percent)