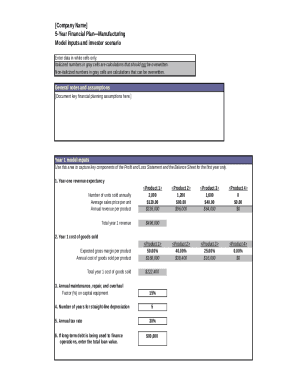

Five Year Financial Plan Template

What is Five Year Financial Plan Template?

A Five Year Financial Plan Template is a structured document that helps individuals or businesses outline their financial goals and projections for the next five years. It includes detailed sections for income, expenses, investments, and savings to provide a comprehensive overview of the financial health and future prospects.

What are the types of Five Year Financial Plan Template?

There are several types of Five Year Financial Plan Templates to choose from, depending on the specific needs and goals of the user. Some common types include: 1. Personal Finance Template 2. Business Financial Forecast Template 3. Strategic Financial Plan Template 4. Projected Financial Statement Template 5. Annual Budget Plan Template

How to complete Five Year Financial Plan Template

Completing a Five Year Financial Plan Template is a detailed process that requires careful consideration and accurate input. To effectively complete the template, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.