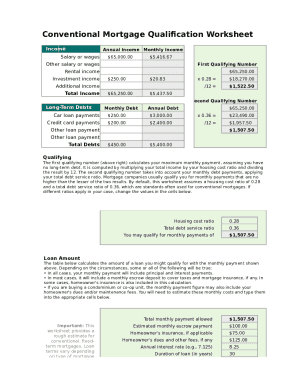

What is Mortgage Qualification Calculation Spreadsheet?

A Mortgage Qualification Calculation Spreadsheet is a tool used to calculate the qualification of an individual for a mortgage based on their financial information. It helps users determine how much they may be approved to borrow for a home loan.

What are the types of Mortgage Qualification Calculation Spreadsheet?

There are several types of Mortgage Qualification Calculation Spreadsheets available, including:

Simple Mortgage Qualification Calculator

Detailed Mortgage Qualification Spreadsheet

Self-Employed Mortgage Qualification Worksheet

How to complete Mortgage Qualification Calculation Spreadsheet

Completing a Mortgage Qualification Calculation Spreadsheet is easy with the following steps:

01

Gather all necessary financial information such as income, expenses, debts, and credit score.

02

Input the gathered information into the appropriate fields in the spreadsheet.

03

Review the calculated qualification amount and adjust inputs as needed for accuracy.

04

Save or print the completed Mortgage Qualification Calculation Spreadsheet for reference during the mortgage application process.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Mortgage Qualification Calculation Spreadsheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate mortgage affordability in Excel?

To figure out how much you must pay on the mortgage each month, use the following formula: "= -PMT(Interest Rate/Payments per Year,Total Number of Payments,Loan Amount,0)". For the provided screenshot, the formula is "-PMT(B6/B8,B9,B5,0)".

How is mortgage qualifying rate calculated?

The mortgage qualifying rate (MQR) is the greater of a floor of 5.25% or your mortgage contract rate + a buffer of 2%. MQR is set by the Office of the Superintendent of Financial Institutions (OSFI) for uninsured mortgages. At the same time, MQR is set by the Department of Finance (DoF) for insured mortgages.

What is the formula for mortgage qualification?

The housing expense ratio (housing-relating expenses divided by gross income) is used in underwriting mortgages. While each lender sets its own qualifying standards, what's generally desirable is a debt-to-income ratio of 36% or less, and a housing expense ratio of 28%.

What is the formula for mortgage payoff?

You can calculate a mortgage payoff amount using a formula. Work out the daily interest rate by multiplying the loan balance by the interest rate, then dividing that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

What is the formula for calculating a 30 year mortgage?

Mortgage payment formula number of payments over the loan's lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360).

How do banks calculate how much mortgage you can get?

Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property taxes, PMI, association dues, insurance, and credit card payments.

Related templates