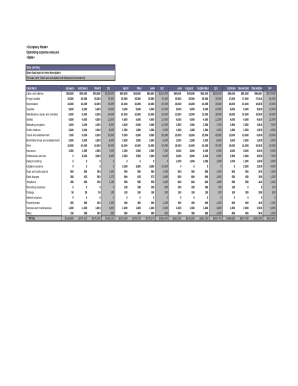

What is Operating Expense Analysis?

Operating expense analysis involves examining a company's operational costs to assess efficiency, identify areas for improvement, and make informed decisions regarding budgeting and cost-cutting strategies. By analyzing these expenses, businesses can gain insights into their financial health and make more informed decisions for future growth.

What are the types of Operating Expense Analysis?

Types of operating expense analysis include: 1. Fixed vs. Variable Costs Analysis: Differentiating between costs that remain constant and those that change based on production levels. 2. Trend Analysis: Evaluating expense trends over time to detect patterns and anomalies. 3. Comparative Analysis: Benchmarking a company's expenses against industry standards or competitors to gauge performance and identify areas for improvement.

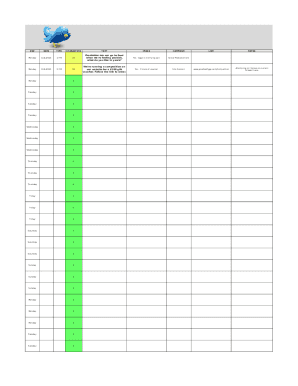

How to complete Operating Expense Analysis

To complete operating expense analysis effectively, follow these steps: 1. Gather all relevant financial data pertaining to operating expenses. 2. Categorize expenses into fixed and variable costs for better analysis. 3. Conduct trend analysis to identify patterns and fluctuations in expenses. 4. Compare your company's expenses to industry benchmarks or competitors for insights. 5. Implement cost-saving measures based on your analysis to improve efficiency.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.