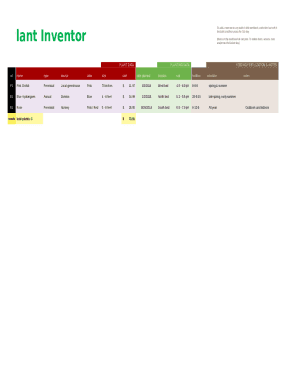

What is Monthly Business Budget Template?

A Monthly Business Budget Template is a tool used by businesses to plan and track their expenses, revenues, and overall financial performance on a monthly basis. It helps businesses to set financial goals, allocate funds effectively, and ensure that they stay on track with their budgetary commitments.

What are the types of Monthly Business Budget Template?

There are several types of Monthly Business Budget Templates that businesses can choose from, depending on their specific needs. Some common types include:

How to complete Monthly Business Budget Template

Completing a Monthly Business Budget Template is crucial for staying financially organized and meeting business goals. Here are some steps to help you effectively complete your Monthly Business Budget Template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.