College Budget Template - Page 2

What is College Budget Template?

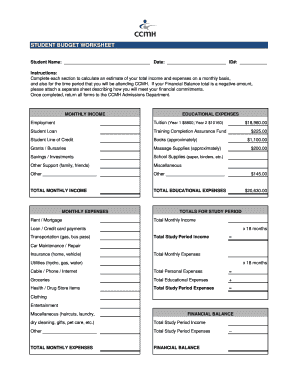

A College Budget Template is a tool that helps students organize and track their expenses and income while attending college. It provides a clear overview of where money is being spent and allows students to make informed financial decisions.

What are the types of College Budget Template?

There are various types of College Budget Templates available to suit different needs and preferences. Some popular types include:

Basic College Budget Template: This template includes essential categories such as tuition fees, textbooks, accommodation, transportation, food, and other miscellaneous expenses.

Detailed College Budget Template: This template provides a more comprehensive breakdown of expenses within each category, allowing for a more detailed analysis of spending habits.

Digital College Budget Template: This template is designed to be used on digital platforms, allowing for easy editing, sharing, and tracking of expenses using tools like pdfFiller.

Printable College Budget Template: This template can be printed out and filled in manually, providing a physical copy for those who prefer a tangible format.

How to complete College Budget Template

Completing a College Budget Template is easy and straightforward. Here are the steps to follow:

01

Gather all relevant financial information, such as income sources (part-time job, scholarships, etc.) and expenses (tuition fees, rent, groceries, etc.).

02

Categorize your expenses and income into specific sections, such as education, housing, transportation, and entertainment.

03

Assign a realistic budget to each category based on your financial situation and priorities.

04

Track your actual expenses regularly and compare them with the budgeted amounts.

05

Make adjustments to your spending habits if necessary to stay within your budget.

06

Review your budget periodically and make changes as needed to ensure it reflects any new financial circumstances or goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a reasonable budget for a college student?

Sample Budget for a College Student Per MonthPer Academic YearTuition and Fees$1,111$10,000Rent/Housing$500$4,500Utilities$200$1,800Cable/Internet$35$31513 more rows

How do you create a simple budget plan?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

How much should a college student spend on expenses?

Average Spending Money for College Students According to Admissionly, depending on how strictly your student budgets, their average monthly spending will likely fall between $1,400 and $2,082 for necessity and non-necessity expenses combined.

How do I write a college budget?

How to create a budget while in college Calculate your net income. List monthly expenses. Organize your expenses into fixed and variable categories. Determine average monthly costs for each expense. Make adjustments.

What are the 7 steps in creating a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

What are the 4 steps to creating a budget?

The following steps can help you create a budget. Calculate your earnings. The first step in creating a budget is to identify the amount of money you have coming in monthly. Pay your bills on timeTrack your expenses. Set financial goals. Review your progress.

Related templates