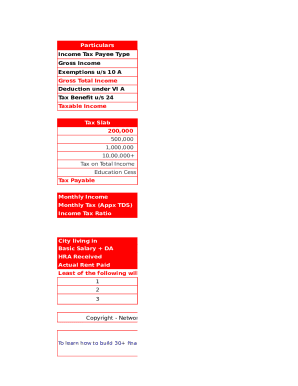

What is Tax Return Calculator 2012?

The Tax Return Calculator 2012 is a tool that helps you calculate your taxes for the year 2012. It takes into account your income, deductions, and credits to determine how much tax you owe or how much refund you might receive.

What are the types of Tax Return Calculator 2012?

There are two main types of Tax Return Calculator 2012:

Online Tax Return Calculator 2012

Downloadable Tax Return Calculator 2012

How to complete Tax Return Calculator 2012

Completing the Tax Return Calculator 2012 is a straightforward process. Here are the steps to follow:

01

Gather all your financial documents for the year 2012, including W-2s, 1099s, and receipts for deductions.

02

Input your income, deductions, and credits into the calculator.

03

Review the calculated tax amount and ensure all information is accurate.

04

Submit the completed Tax Return Calculator 2012 electronically or by mail to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tax Return Calculator 2012

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I calculate my total tax refund?

Simple Summary. Every year, your refund is calculated as the amount withheld for federal income tax, minus your total federal income tax for the year.

How can I get my tax return from 20 years ago?

You can request old tax returns from the Internal Revenue Service (IRS). For more details, see: https://.irs.gov/taxtopics/tc156.html. The Social Security Administration provides copies of old W-2s or related Social Security documents. For more details, visit: https://faq.ssa.gov/en-us/Topic/article/KA-02501.

What were the tax rates for 2012?

Heads of Households Taxable Income2012 TaxNot over $12,40010% of the taxable incomOver $12,400 but not over $47,350$1,240 plus 15% of the excess over $12,400Over $47,350 but not over $122,300$6,482.50 plus 25% of the excess over $47,350Over $122,300 but not over $198,050$25,220 plus 28% of the excess over $122,3002 more rows

What is 1040?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

How to calculate tax return with 1040?

How Do I Calculate My Tax Return? Your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). Subtract line 24 from line 33. If the amount on line 33 is larger than the amount on line 24, that's what you overpaid.

How do I find previous tax returns UK?

So, how can you access this information? HM Revenue & Customs (HMRC) provides the information online. or paper originals will continue to be acceptable if you do not have access to the internet. These can be ordered by you (or your Accountant) by calling 0300 200 3310.

Related templates